In a historic moment for South Africa's banking landscape, TymeBank, established in 2019, has achieved its first-ever profit, nearly five years post-launch.

TymeBank's Mission and Growth Strategy

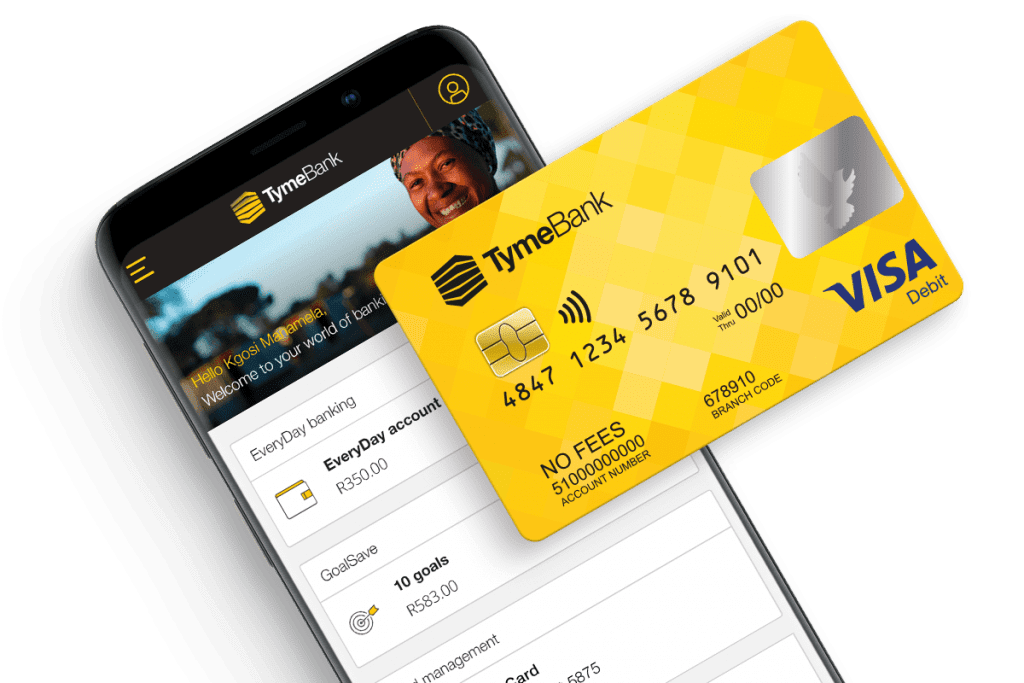

TymeBank has consistently targeted underprivileged and economically marginalized groups, providing easily accessible, affordable, and quality banking services. Founder and Chairman of African Rainbow Capital (ARC), Patrice Motsepe, commended the fintech for its historic profitability, highlighting more than four years of dedicated work and unwavering commitment to its core mission.

Ownership Structure

ARC holds the majority of shares in TymeBank, with a controlling stake of 57.7%. Other notable investors include African Fig Tree (AFT), JG Summit Holdings (JG Summit), Chinese International Investment (BII), Apis Growth Fund II, and the Ethos AI Fund. This diverse ownership structure reflects confidence in TymeBank's vision and potential.

Financial Performance

TymeBank's annual revenue run rate surpassed R1.8 billion, equivalent to roughly $95 million, according to ARC's previous financial reports. The journey to profitability saw cumulative losses of R6.6 billion (~$347 million). In the context of the global digital banking landscape, where only approximately 5% of digital banks are profitable, TymeBank's achievement is noteworthy.

Strategic Partnerships and Hybrid Approach

TymeBank attributes its success to a unique hybrid approach that combines digital channels with walk-in kiosks. Long-standing partnerships with retailers like Pick n Pay, Boxer, and TFG have played a crucial role. The company emphasizes the value of loyal customers and the confidence of its shareholders in contributing to this milestone.

Fundraising and Market Position

In May 2023, Norrsken22 and Blue Earth Capital led a pre-Series C round, raising $77.8 million for TymeBank. This significant investment underscores the fintech's position as one of the world's fastest-growing digital banks. Notably, competitors Bank Zero and Discovery Bank are yet to achieve profitability.

CEO's Perspective

Coenraad Jonker, CEO of TymeBank, expressed pride in this accomplishment, noting that less than half of the top 100 digital banks globally are profitable. He positioned TymeBank's profitability as a South African success story that should be celebrated by its 8.5 million customers.

TymeBank's journey to profitability serves as an inspiring narrative in the digital banking space. As it breaks boundaries and sets new standards, the fintech's commitment to financial inclusion and innovation remains at the forefront, marking a pivotal moment in South Africa's banking evolution.