Introduction

Chipper Cash, a major player in African fintech, has joined forces with TBD, a digital payment platform backed by tech entrepreneur Jack Dorsey. This collaboration aims to enhance financial inclusion across Africa, leveraging TBD's support from Block Inc., formerly known as Square.

Strategic Collaboration

The partnership between Chipper Cash and TBD marks a significant step in expanding TBD’s reach to 40 countries across the African continent. Mike Brock, CEO of TBD, discussed the collaboration in an interview from Accra, Ghana, highlighting the ambitious scope of this venture.

Background of TBD

TBD was established just over two years ago by Block Inc., co-founded by Jack Dorsey, who is also a co-founder of Twitter (now X). The platform's mission is to enhance financial inclusion for individuals, businesses, and payment platforms, especially in regions with limited traditional banking infrastructure.

Jack Dorsey’s Vision for Africa

Dorsey has been a vocal advocate for Africa’s potential, particularly regarding cryptocurrency adoption and decentralization. His visit to several African countries in 2019 reinforced his belief in the continent's future impact, especially in the cryptocurrency space. Despite the pandemic and other challenges preventing his temporary relocation to Africa, Dorsey has continued to support the African crypto ecosystem through various ventures and investments.

Dorsey's Commitment to African Crypto Ecosystem

Dorsey's involvement extends to investments in African enterprises such as Yellow Card, a crypto startup that partnered with Block on cross-border transfers, and financial and data technology companies Fedi and Gridless. In September 2023, Btrust, a non-profit formed by Dorsey and rapper Jay-Z, acquired Qala, an organization training African Bitcoin and Lightning engineers, further solidifying his commitment to the region.

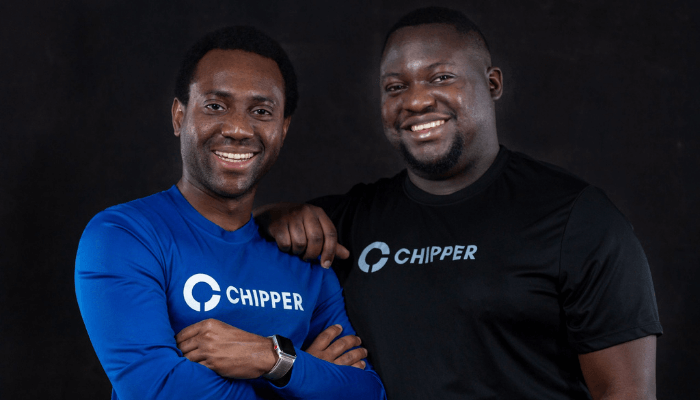

Chipper Cash's Role and Reach

Chipper Cash, based in San Francisco, serves a customer base of 5 million, facilitating money transfers across 21 African countries. Unlike traditional money transfer methods that are slow and limited to fiat currencies, TBD offers a unique advantage by supporting digital assets, enabling quick transfers with flexible payment options.

Innovative Payment Solutions

TBD’s platform allows recipients to receive funds in local currency directly into their bank accounts or mobile wallets. Alternatively, they can choose to hold their funds in dollars, bitcoin, or stablecoins. This flexibility is a significant enhancement over conventional financial systems.

Commitment to Financial Inclusion

Mike Brock, CEO of TBD, emphasized the platform's role in bridging the gap between traditional financial practices and the emerging digital asset landscape. TBD is dedicated to fostering engagement within this ecosystem, encouraging participation from developers, fintech startups, banks, and institutions.