Introduction

Nigerian neobank, Carbon, has recently announced the cessation of its debit card operations. The news was disclosed by Carbon Co-founder Ngozi Dozie in a Substack post, where he elaborated on the decision to discontinue the service. An email notification has already been sent to all debit card holders, informing them that card operations will end June 19th.

Reasons Behind the Shutdown

Although Dozie did not explicitly state the reasons for shutting down the debit card operations, he hinted at the high operational costs denominated in US dollars as a significant factor. He reflected, “When I take a step back with the benefit of hindsight (and a card operation bill denominated in USD$), I question why practically all neobanks are pushing cards or even getting into it. Was this the right strategy for ALL of us, or was Carbon just unlucky?”

Strategic Reflections

Dozie’s remarks suggest that the decision may have stemmed from a broader reflection on the strategy of issuing debit cards. He admitted that, in hindsight, a thorough evaluation might have led to a more cautious approach. “If I had done the analysis suggested above and truly evaluated the opportunity, I don’t think I would have been that gung-ho about pushing a strategy to provide consumers with their fifth debit card. The decision might have been the same, but perhaps with more respect for the potential risks,” he confessed.

Carbon's Debit Card Journey

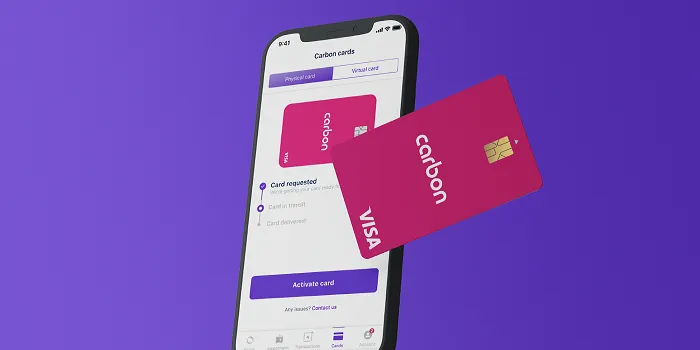

In June 2021, Carbon launched its debit card service after forming a five-year partnership with tech giant Visa. This collaboration aimed to issue both virtual and physical debit cards to customers across Africa. The initiative was part of Carbon’s promise to deliver a safe and reliable banking experience across all touchpoints. However, this ambitious project has now come to an unexpected halt.

Comparison with Other Fintechs

While Carbon and other Nigerian fintechs like Kuda partnered with global card schemes such as Visa and Mastercard, some, like Moniepoint, opted for local solutions like Verve. The decision to partner with global card schemes was likely influenced by the perceived global appeal, financial support from these schemes, and the ability to use the cards internationally. However, this strategy did not fully account for the high costs associated with dollar-denominated operational fees and the balance between local and foreign transactions.

Implications and Future Prospects

The shutdown of Carbon’s debit card operations will affect its customers who relied on these cards for their financial transactions. The company has assured users that they have been informed well in advance to make alternative arrangements.

Strategic Realignment

Carbon’s decision to halt its debit card services reflects a strategic realignment. The neobank may now focus on other areas where it can provide value to its customers without incurring unsustainable costs. This move could lead to the development of new products or services better aligned with the company’s long-term vision and financial health.