Introduction

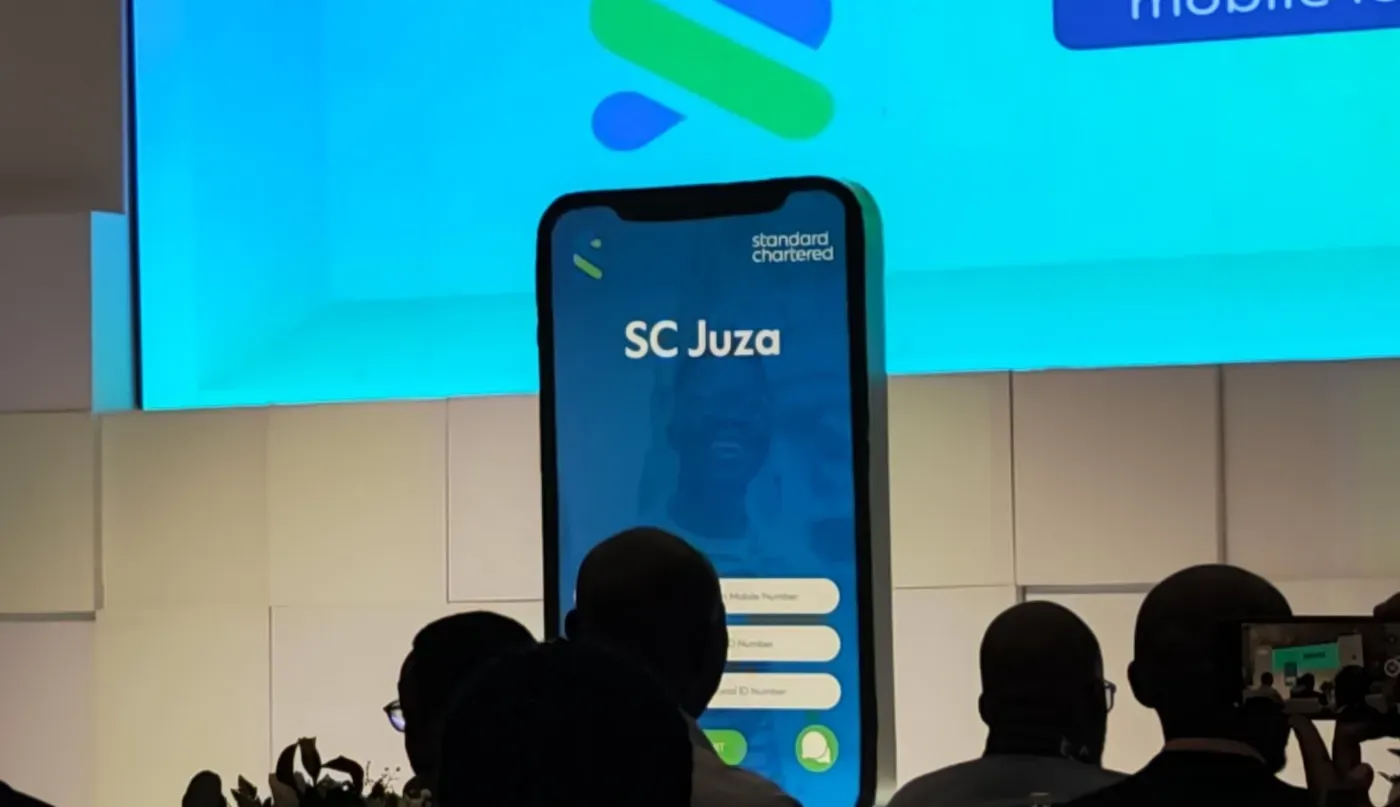

Standard Chartered Bank recently launched SC Juza, a mobile app designed to cater to the increasing demand for short-term, unsecured loans disbursed through mobile wallets.

Entering the Digital Lending Market

With SC Juza, Standard Chartered joins other Kenyan banks like KCB, ABSA, Equity Bank, and NCBA in the competitive digital lending market. Currently available only on Android, an iOS version is set to launch soon.

How SC Juza Works

To access loans, users need to:

- Download the app.

- Register and create a personalized PIN.

- Provide personal details and a Safaricom mobile number.

Loans are disbursed directly to the user's MPESA number, making it accessible to all, not just Standard Chartered Bank customers.

Interest Rates and Repayment Period

- Processing Fee: 5.5% per loan (e.g., KES 55 for a KES 1,000 loan).

- Interest Rate: 1.6% per month (KES 10.80 on a KES 1,000 loan).

- Loan Tenure: 60 days, with the service fee applied only after the first 30 days.

- Daily Interest Accrual: Ensures clear and cumulative borrowing costs.

- Loan Range: KES 1,000 to KES 100,000.

Additional Features

- Transaction Tracking: View mini statements and manage loan costs.

- Customer Support: A fully digitized chat support platform for user convenience.