A Strategic Financial Boost

The Kenya Development Corporation (KDC) has provided a significant financial boost to Murang'a County by advancing a Sh300 million credit facility to Amica Savings and Credit Ltd, a prominent local savings and credit cooperative society (Sacco). This strategic move is set to empower local businesses, particularly in the agriculture, trade, and manufacturing sectors.

Empowering Local Enterprises

Amica Sacco’s Chief Executive Officer, James Mbui, emphasized the critical role this loan will play in strengthening the cooperative’s capacity to support local enterprises. "This loan facility will go a long way in meeting our strategic plan of creating an institutional culture of excellence even as we aim to realize and hopefully surpass our Sh1.2 Billion revenue target for the year," Mbui stated. The funds will enable the Sacco to extend much-needed credit to its members, fostering business growth and sustainability in the region.

A Landmark Agreement with Long-Term Vision

This credit facility marks a significant milestone as KDC has set an unprecedented 10-year repayment period for the loan—an innovative approach under KDC’s Supporting Access to Finance and Enterprise Recovery (SAFER) Project. This project is part of a broader initiative supported by the World Bank, designed to address the severe financial challenges faced by micro, small, and medium enterprises (MSMEs) in Kenya, particularly in the aftermath of the COVID-19 pandemic.

A Comprehensive Support System

The SAFER initiative is a comprehensive program aimed at revitalizing the MSME sector. It includes liquidity support to SMEs, de-risking lending through strengthening the national credit guarantee, and offering technical assistance and project management to participating financial institutions (PFIs), such as regulated SACCOs, microfinance banks, and commercial banks. This holistic approach ensures that MSMEs receive the financial and technical support necessary to recover and thrive in a challenging economic environment.

KDC’s Commitment to Community Prosperity

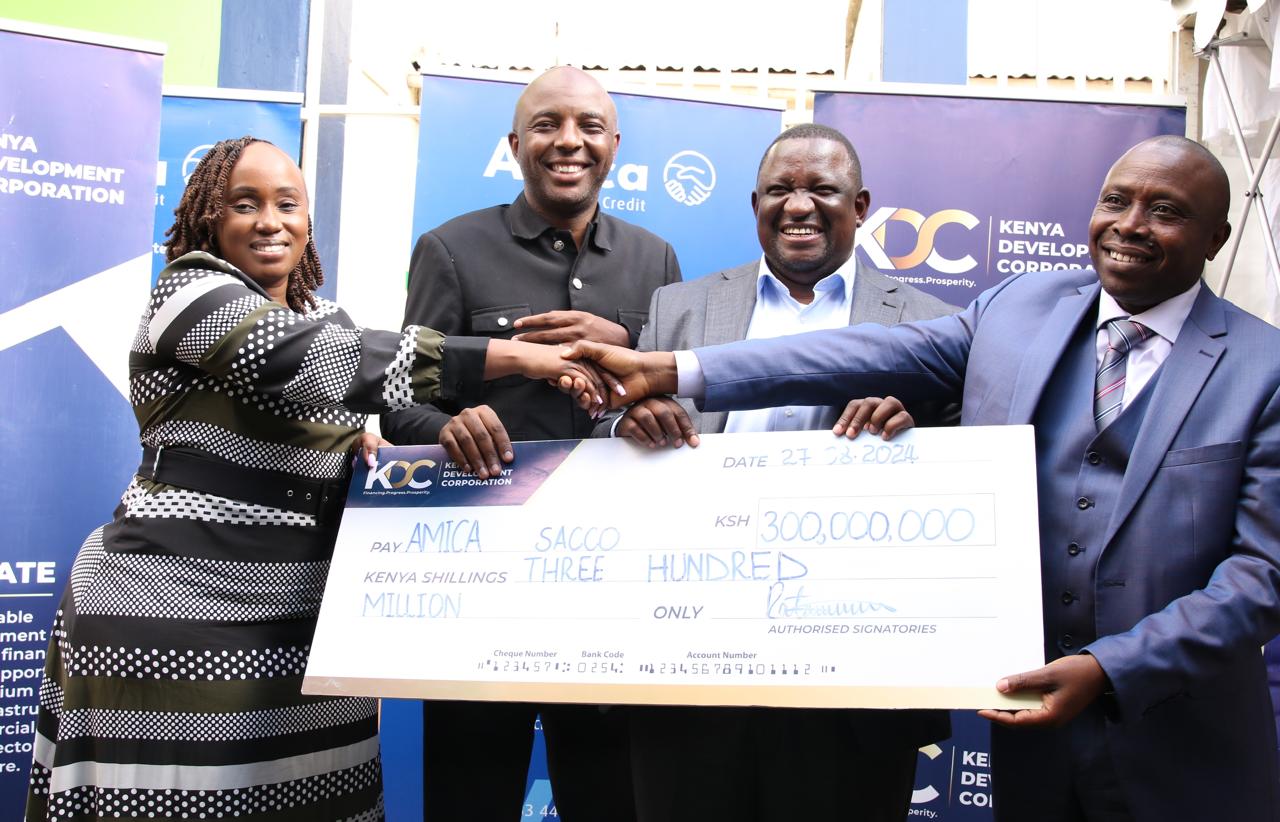

KDC’s Director-General, Norah Ratemo, highlighted the transformative impact of the Sh300 million facility on Murang’a County. "The KES 300 million facility is a pivotal investment in Murang’a County’s future. It will enable Amica Sacco to provide crucial support to local businesses as they recover and expand, spark economic activity, and drive overall community prosperity," Ratemo stated during the cheque presentation ceremony.

Addressing Market Failures and Supporting MSMEs

Ratemo also noted the exacerbation of pre-existing market failures due to the pandemic, which severely limited MSMEs’ access to essential credit. The SAFER project, which spans 25 years with the first five years dedicated to implementation, is structured into three interrelated components: liquidity support, de-risking lending, and providing technical assistance. This structure ensures that MSMEs receive comprehensive support to navigate the post-pandemic economic landscape.

Growing Demand for Financial Support

The demand for financial support under the SAFER project has been overwhelming, with KDC receiving 41 applications totaling Sh15 billion in loan requests from various entities. This surge in demand highlights the pressing need for financial assistance amid a shaky economy and unpredictable tax policies. To date, KDC’s credit facilities have benefitted four counties, signaling the broad impact and reach of this initiative.