Fido's Strategic Growth and Investment Milestone

Ghanaian fintech company Fido has successfully raised $30 million in Series B funding, consisting of a $20 million equity investment and $10 million in debt financing. The funding round was led by Dutch entrepreneurial development bank FMO and BlueOrchard, marking a significant milestone in Fido's expansion strategy. The company plans to use this capital to extend its operations into East and Southern Africa, furthering its mission to provide financial services to underserved populations.

Founding Vision: Bridging the Financial Services Gap

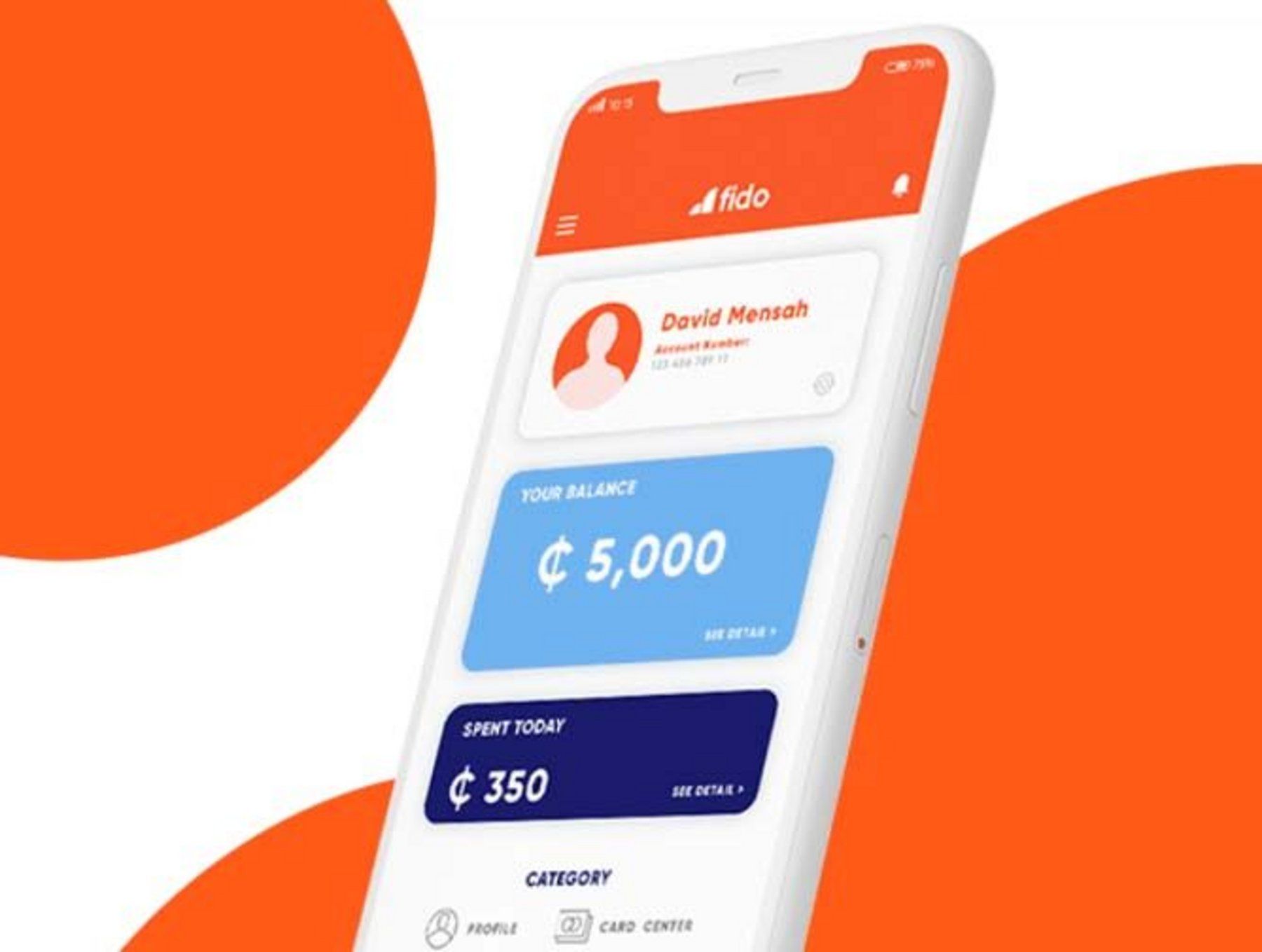

Fido was co-founded in 2015 by Tomer Edry, Nir Zepkowitz, and Nadav Topolski with a clear objective: to offer micro-loans via mobile phones to individuals and small-to-medium enterprises (SMEs) who lack access to traditional banking services. Over the years, Fido has expanded its product offerings to include bill payments and savings options, diversifying its revenue streams and enhancing its value proposition to customers.

Innovation at the Core: Leveraging Mobile Technology and Data for Financial Inclusion

At the heart of Fido’s success is its innovative use of mobile technology and alternative data sources to deliver quick micro-loans. By harnessing these technologies, Fido can assess the creditworthiness of individuals and SMEs who are typically excluded from formal financial systems. This approach allows the fintech to provide loan products embedded with insurance options, and it plans to introduce additional packages such as climate and tradesman insurance to further meet the needs of its customers.

CEO's Perspective: Building a Financial Ecosystem from Scratch

Alon Eitan, Fido's CEO, emphasized the fintech's impact on the underbanked population in sub-Saharan Africa. "A majority of the population in sub-Saharan Africa are either unbanked or underbanked. For many customers, we are their first interaction with financial services. We help them build a financial backbone within our ecosystem, where they can access credit, insurance, make savings, purchase mobile phones, and run their businesses," Eitan explained.

AI-Powered Financial Solutions: Delivering Competitive Loan Rates

Fido's ability to offer competitive loan rates is driven by its advanced AI models that optimize the loan lifecycle. The fintech's acquisition model utilizes mobile device data and other alternative sources to score new customers, helping mitigate fraud and improve service delivery. This AI-driven approach has allowed Fido to serve a million customers to date, with 40% of them being SMEs. The company has disbursed $500 million in loans across Ghana, a testament to its growing influence in the region.

Expansion Plans: Aiming for a Billion in Disbursements

Looking ahead, Fido's ambitions are clear. The company aims to surpass a billion dollars in total loan disbursements by early next year, using the newly secured funds to reach more customers and deepen its impact. "Our goal is to grow further and have a genuine impact on our customers," Eitan concluded, highlighting Fido's commitment to financial inclusion and economic empowerment across Africa.