Introduction

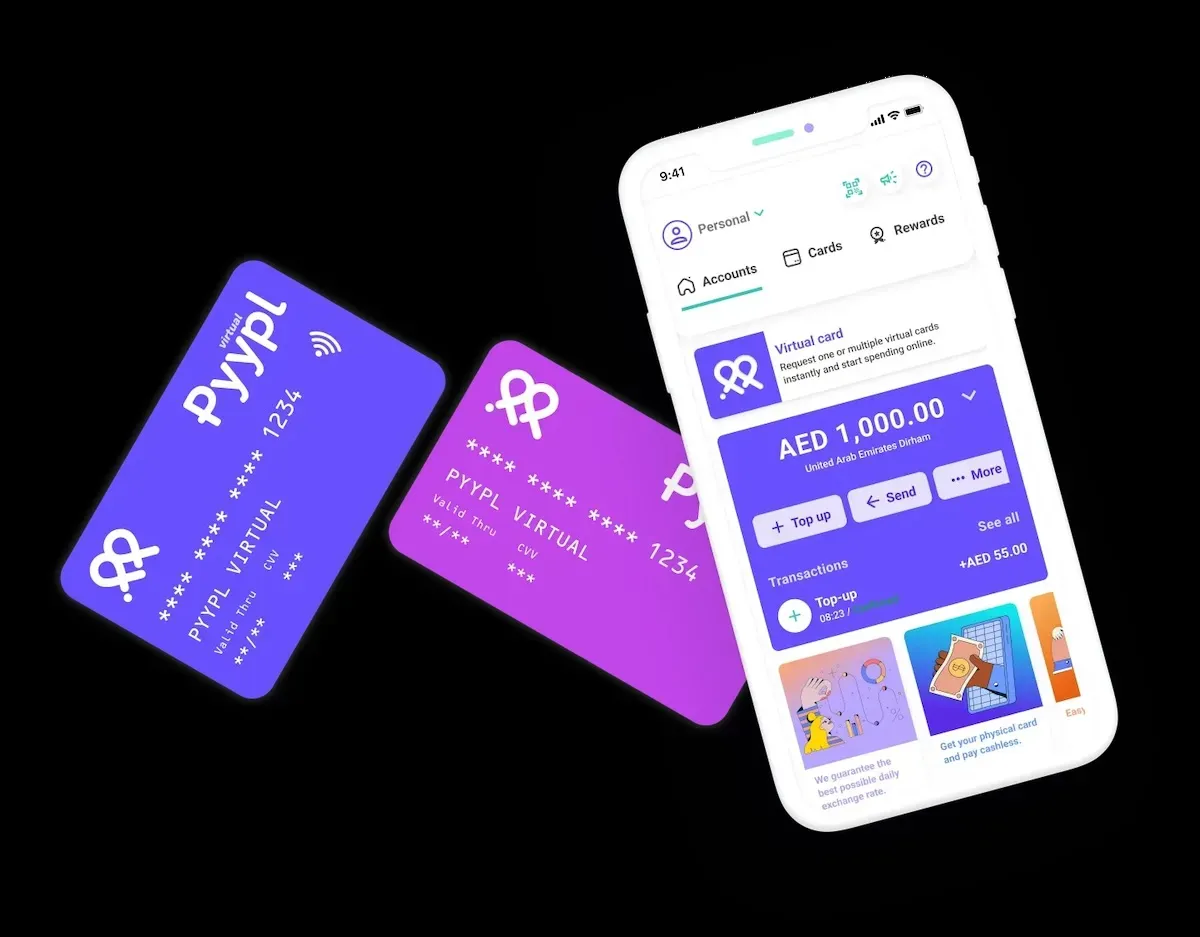

Pyypl, a fintech firm operating in the Middle East and Africa (MEA), has announced a strategic partnership with Visa to issue virtual and physical Visa cards directly to users through its mobile application. This collaboration aims to advance financial inclusion across the region.

Approval and Support from Local Regulators

Pyypl's new partnership with Visa is supported by local regulators, enabling the fintech to provide access to prepaid Visa cards in various markets swiftly. This initiative aims to accelerate financial inclusion in the MEA region by leveraging regulatory support to roll out financial services efficiently.

Benefits of the Partnership

Antti Arponen, CEO and co-founder of Pyypl, expressed excitement about the collaboration with Visa. He emphasized that the partnership will significantly enhance Pyypl's payment ecosystem, benefiting Visa and helping to deliver financial services to the underserved digital population in the region.

Transforming Financial Services

Pyypl operates in several markets across Africa and the Middle East, targeting 850 million underserved smartphone users. The integration of Visa virtual cards into Pyypl's services aims to transform and digitize financial services for these users, providing greater access and convenience.

Ambitious Goals

Pyypl aspires to become the leading fintech payment services provider in the MEA and Central Asia regions. By offering Visa cards, Pyypl intends to elevate its users from reliance on cash and mobile money to embracing the digital payments ecosystem.

Integrating into the Digital Economy

Hasan Kazmi, Vice President and Head of Strategic Partnerships and Ventures for CEMEA at Visa, highlighted the potential of this partnership to empower underbanked consumers. By providing innovative and secure payment solutions, the collaboration aims to integrate these consumers into the digital economy, helping them thrive in the digital age.

Enhancing Financial Inclusion

Kazmi noted that the partnership with Pyypl is aligned with Visa’s mission to provide underbanked consumers with access to the digital economy. This effort is expected to contribute significantly to financial inclusion and economic empowerment in the region.